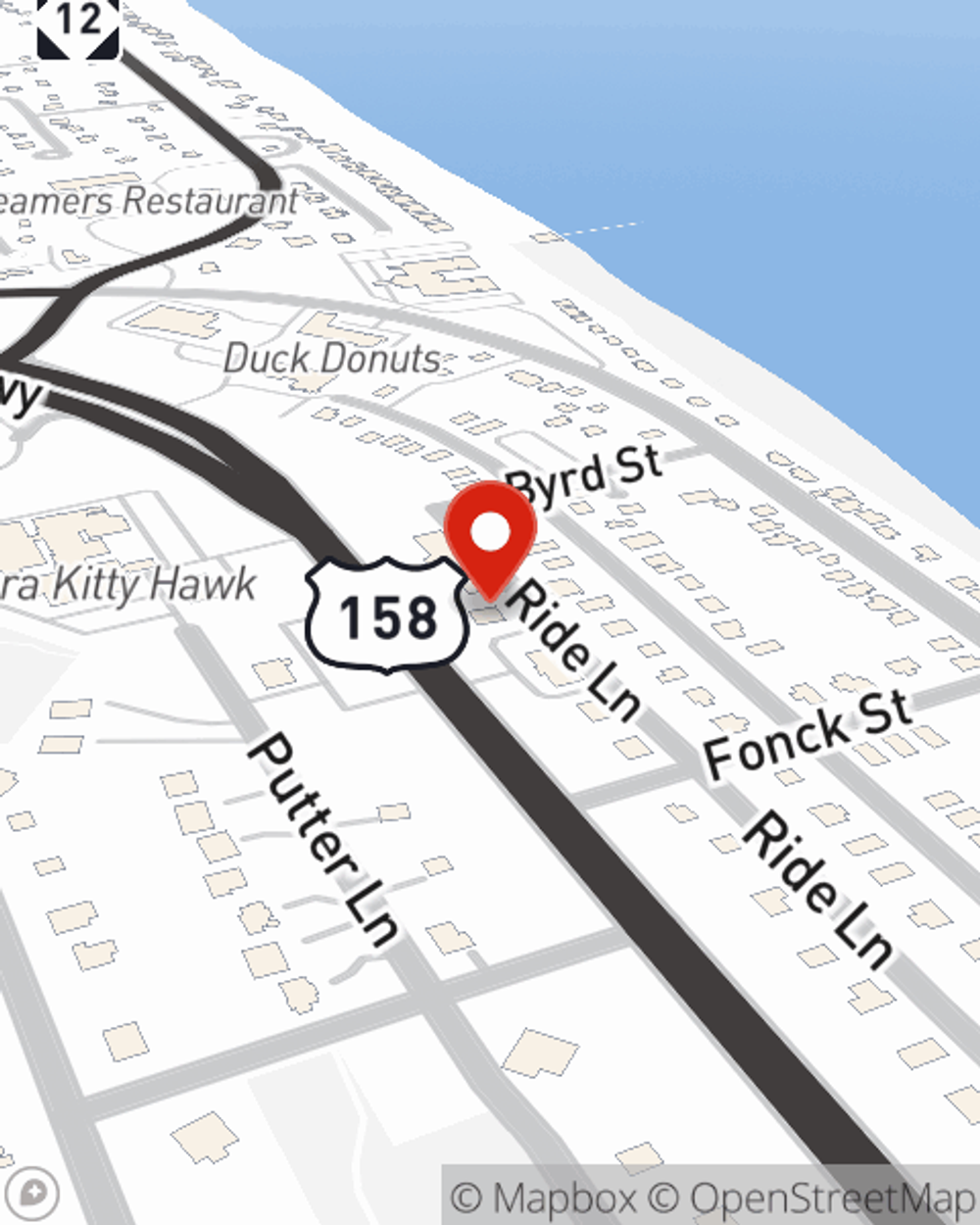

Homeowners Insurance in and around Kitty Hawk

Protect what's important from the unexpected.

Help cover your home

Would you like to create a personalized homeowners quote?

- Kill Devil Hills

- Currituck

- Grandy

- Moyock

- Chesapeake VA

- Point Harbor

- Suffolk VA

- Virginia Beach VA

- Nags Head

- Powells Point

- Elizabeth City

- Hertford

- Edenton

- Manteo

- camden

- duck

- corolla

- buxton

- waves

With State Farm's Insurance, You Are Home

Your home and property have monetary value. Your home is more than just a structure. It’s all the memories packed in and attached to it. Doing what you can to keep your home protected just makes sense! And one of the most reasonable things you can do is to get outstanding homeowners insurance from State Farm.

Protect what's important from the unexpected.

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

State Farm's homeowners insurance safeguards your home and your keepsakes. Agent Steven Gillis is here to help build a policy with your specific needs in mind.

Remarkable homeowners insurance is not hard to come by at State Farm. Before the accidental occurs, get in touch with agent Steven Gillis's office to help you figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Steven at (252) 261-3350 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

Hurricane evacuation and preparedness plan

Hurricane evacuation and preparedness plan

Preparing for a hurricane and having an evacuation plan can help keep you, your family and pets safe, and may help protect the property you leave behind.

Steven Gillis

State Farm® Insurance AgentSimple Insights®

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

Hurricane evacuation and preparedness plan

Hurricane evacuation and preparedness plan

Preparing for a hurricane and having an evacuation plan can help keep you, your family and pets safe, and may help protect the property you leave behind.